- Under a perpetual inventory system update#

- Under a perpetual inventory system software#

- Under a perpetual inventory system professional#

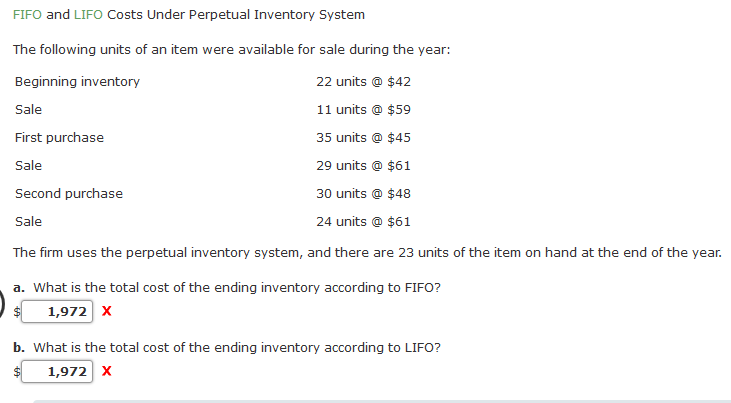

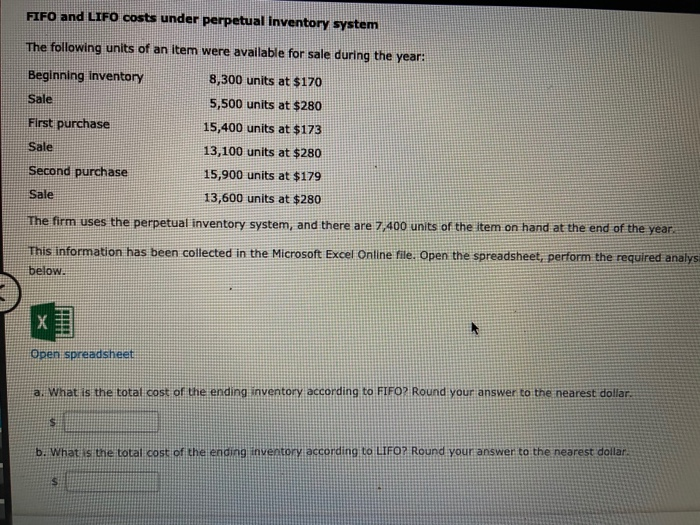

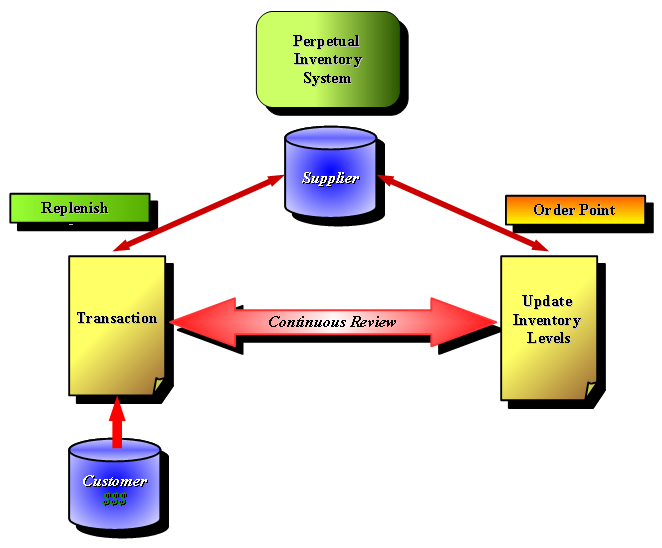

Is It Necessary to Take a Physical Inventory When Using the Perpetual Inventory System?.What Is the Difference Between a Perpetual Inventory System and a Periodic Inventory System?.What Are the Advantages of the Perpetual Inventory System?.How Do I Calculate Perpetual Inventory?.It is, therefore, the standard inventory tracking system used by businesses that maintain a large inventory. Unlike the periodic inventory management system, the perpetual inventory management system precisely reflects the level of goods on hand. This inventory management system provides a thorough view of inventory changes and allows for immediate tracking and reporting of the amount of inventory in stock. These updates include sales and purchases through computerized point-of-sale systems and enterprise asset management software. The perpetual inventory system involves the continuous updating of inventory records. Send invoices, track time, manage payments, and more…from anywhere.

Under a perpetual inventory system software#

Pay your employees and keep accurate books with Payroll software integrationsįreshBooks integrates with over 100 partners to help you simplify your workflows Set clear expectations with clients and organize your plans for each projectĬlient management made easy, with client info all in one place Organized and professional, helping you stand out and win new clients Track project status and collaborate with clients and team members Time-saving all-in-one bookkeeping that your business can count on Tax time and business health reports keep you informed and tax-time readyĪutomatically track your mileage and never miss a mileage deduction again Reports and tools to track money in and out, so you know where you standĮasily log expenses and receipts to ensure your books are always tax-time ready Quick and easy online, recurring, and invoice-free payment optionsĪutomated, to accurately track time and easily log billable hours

Under a perpetual inventory system professional#

However, most companies would record the sale in a sales journal.Wow clients with professional invoices that take seconds to create The general journal provides a simple, consistent format to present new information.

Under the periodic system, the inventory and cost of goods sold accounts are updated only periodically, but under the perpetual system, entries that recognize a transaction's effect on these accounts occur when the revenue from the sale is recognized.įor convenience, a sale or sales return can be recorded under the perpetual system with a compound entry that lists all four accounts. A sales return has the opposite effect on the same accounts. Second, the flow of merchandise between inventory (an asset) and cost of goods sold (an expense) is recorded in accordance with the matching principle.

First, the sales transaction's effect on revenue must be recognized by making an entry to increase accounts receivable and the sales account. (Note: Ap stands for accounts payable, and AR stands for accounts receivable.)Īs the two sets of circled entries indicate, two things happen when there is a sale or a sales return. The reference columns are removed from the illustration to simplify what you're seeing. Consider several entries under both systems. Under the perpetual system, purchases, purchase returns and allowances, purchase discounts, sales, and sales returns are immediately recognized in the inventory account, so the inventory account balance should always remain accurate, assuming there is no theft, spoilage, or other losses. Perpetual inventory systems have traditionally been associated with companies that sell small numbers of high‐priced items, but the development of modern scanning and computer technology has enabled almost any type of merchandiser to consider using this system. Under the periodic system, merchandise purchases are recorded in the purchases account, and the inventory account balance is updated only at the end of each accounting period. Inventory Errors and Financial StatementsĬompanies may use either the perpetual system or the periodic system to account for inventory.Inventory Systems: Perpetual or Periodic.Recording Notes Receivable Transactions.Subsidiary Ledgers and Special Journals.

Under a perpetual inventory system update#

0 kommentar(er)

0 kommentar(er)